Date: 08-07-2019

As the Chinese population becomes more affluent and consumer preferences become more sophisticated, demand for imported brands and goods have soared. Total import value of foreign goods hit a record RMB 30,505 billion in 2018, a growth of almost 10% from 2017, and is expected to maintain steady growth over the next few years. Despite the rapid increase in demand, many foreign brands still find it challenging to enter the Chinese market. In this article, we explore 3 key routes of China market entry and explore the pros and cons of each method.

1. Direct Importation

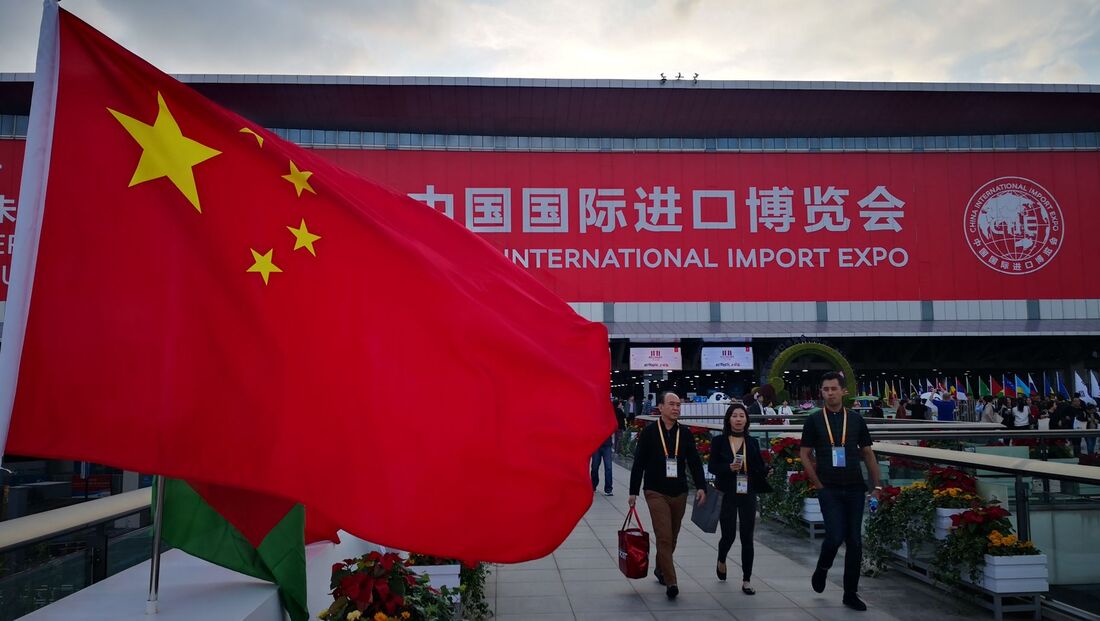

The inaugural China International Import Expo in 2018

The traditional method of China market entry is through a direct importation model (aka 一般贸易). The direct importation model allows for businesses to ship their products directly into the warehouses of appointed distributors, and be sold through retailers online and offline. Traditional importation regulations are strict, and may even include lab-testing for categories such as skincare and beauty, which ensures that approved products are of high reliability and trustworthiness.

However, few brands have taken this route due to the numerous challenges that they present. One of the key prerequisites for the registration of direct importation is the need for a China-registered company or office. For SMEs, this presents a huge barrier-to-entry. Furthermore, the cost of registration per SKU is high, with a long approval process. With the fast-moving consumer trends in China, this poses a challenge for categories such as skincare, beauty, and fashion. At the same time, brands may also be required to not only redesign their packaging, but also reformulate certain products to comply to local regulations, presenting additional costs in R&D and manufacturing to businesses.

The difficulties presented through this method, coupled with the demand fuelled by consumers, has led to both foreign businesses and consumers to explore alternative methods of getting foreign goods into China.

2. Daigou

"928 Daigou Crackdown" at Shanghai Pudong International Airport. Image via China National Radio

Daigou (代购) literally translates to "buying on behalf", or "surrogate shopping" in English. Originally started as a means for locals to obtain hard-to-find foreign products through friends and family members who are overseas, Daigou rapidly evolved into a lucrative industry with what is now known as Daigou syndicates. Daigou syndicates are groups of professionals who purchase commodities for customers in China while circumventing any importation taxes and tariffs that may be incurred through official importation methods.

The benefits to consumers are numerous; from being able to purchase products that are not available in the local market, to the lower cost of products for luxury items. At the same time, there are risks presented through this unofficial method of importation. Due to the lack of regulation of Daigou, one of the highest risks is in the authenticity and the quality of the products, particularly in the purchasing of products from Daigou syndicates.

To curtail the negative impacts of Daigou, the Chinese government has started cracking down on Daigous, most infamously through the 928 Daigou crackdown incident, a day of airing footage of Daigous being searched and fined at the Shanghai Pudong International Airport as a warning to potential Daigous. Furthermore, to encourage consumers to purchase through legitimate means, the Chinese government has introduced new cross border e-commerce policies, at the same time allowing more foreign merchants ease-of-access to the Chinese market.

3. Cross Border E-Commerce

Tmall Global - bringing the world to China

Unlike the traditional importation method, for brands entering China through cross border e-commerce (CBEC), foreign brands are only allowed to sell their products via e-commerce marketplaces in China through platforms such as Taobao, Tmall, or Jingdong (JD).

One of the key advantages is the lowered cost and reduced time to enter into the market. Through CBEC, businesses do not need register companies in China, significantly reducing the cost of entry especially for smaller brands and businesses. The lead time for approval of products for listing and selling on e-commerce marketplaces can also be as quick as 1 to 2 weeks, allowing for merchants to have their goods available to end-consumers in as short a time frame as possible. The lower cost of entry also means that the risk taken for businesses is minimised, allowing them more time and opportunities to understand their consumers, and their tastes and preferences.

With much of the shopping in China being done on e-commerce and m-commerce and the relaxation of policies on cross border e-commerce, this has become one of the key contributors to importation growth of the country.